unified estate and gift tax credit 2020

The previous limit for 2020 was 1158 million. Estate and Gift Taxes.

Gift Tax Exclusion Essential Info Understand The Unified Credit

Unified estate and gift tax credit 2020 Tuesday March 15 2022 Edit.

. Insolvency Professional And Its Role Under Ibc 2016 Insolvency Limited Liability Partnership Company Secretary Polis Signs 270 Million Small Business Loan And Grant Programs Into Law Denver Busin Small Business Loans Small Business Development Center Business Journal. In general the Gift Tax and Estate Tax provisions apply a unified rate schedule to a persons cumulative taxable gifts and taxable estate to arrive at a net tentative tax. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

The United States has taxed the estates of decedents since 1916. Learn more about estate taxes by. Not over 2600 10 of taxable income.

The 117 million exception in 2021 is set to expire in 2025. For 2009 tax returns every American received an automatic unified tax credit against federal estate and gift taxes of 1455800 which is equivalent to transferring 35 million tax-free to your heirs. The IRS announced new estate and gift tax limits for 2021 during the fall of 2020.

For 2020 the basic exclusion amount will go up 180000 from 2019 levels to a new total of 1158 million. The annual gift tax exclusion is 16000 for tax year 2022 up from 15000 from 2018 through 2021. The estate tax is a tax on your right to transfer property at your death.

Gifts made each year in excess of the 16000 annual limit per recipient reduce your federal giftestate tax exemption when you die. The unified tax credit is designed to decrease the tax bill of the individual or estate. The generation-skipping transfer tax is an additional tax on a transfer of property that skips a generation.

The 1206 million exemption applies to gifts and estate taxes combinedany portion of the exemption you use for gifting will reduce the amount you can use for the estate tax. Ad Complete IRS Tax Forms Online or Print Government Tax Documents. Under TRA 1997 the unified credit remains unchanged for decedents dying and gifts made during 1997.

Estate and Gift Taxes. It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. It consists of an accounting of everything you own or have certain interests in at the date of death.

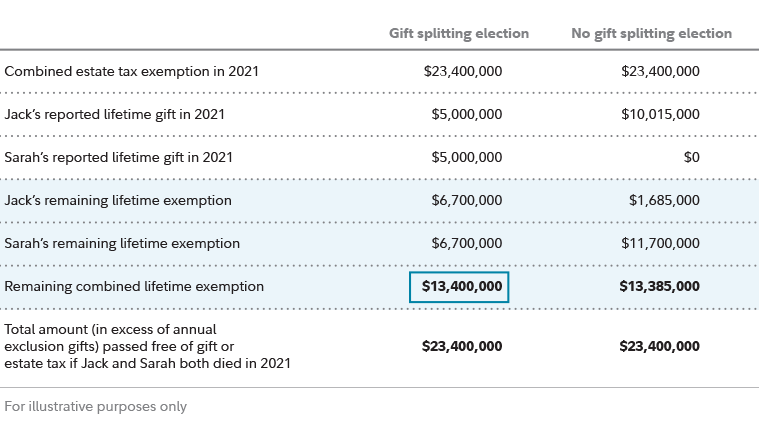

The first 16000 is not taxable because of the annual exclusion. The amount of the Unified Credit is currently higher than it has ever been while an estate tax is. As of 2021 married couples can exempt 234 million.

Find some of the more common questions dealing with basic estate tax issues. Citizen received the same exemption credit so that you could as a couple give a full 7. Unified estate and gift tax credit 2020 Tuesday March 15 2022 Edit.

2020 Year End Tax Letter For Individuals Bsb. 5 You can give up to this amount in money or property to any individual per year without incurring a gift tax. This is called the unified credit.

The estate and gift tax exemption is. The IRS refers to this as a unified credit Each donor the person making the gift has a separate lifetime exemption that can be used before any out-of-pocket gift tax is due. The unified gift and estate tax credit is the current shelter amount for gifting during ones lifetime and at ones death.

In other words the unified credit is one pool of credit. Any tax due is determined after applying a credit based on an applicable exclusion amount. That number is used to calculate the size of the credit against estate tax.

It can be used by taxpayers before or after death integrates both the gift and estate taxes into one tax system is adjusted for inflation and has no income limit. Individuals who are concerned their wealth may surpass any future unified tax credit should consider additional estate planning strategies to lock in the 117 million exemption. For 2021 the estate and gift tax exemption stands at 117 million per person.

If you were married your spouse also a US. A key component of this exclusion is the basic exclusion amount BEA. Gifts and estate transfers that exceed 1206 million are subject to tax.

Then there is the exemption for gifts and estate taxes. The lifetime gift tax exclusion in 2020 is 1158 million meaning the federal tax law applies the estate tax to any. For 2021 that lifetime exemption amount is 117 million.

For 2022 the exemption increases to 1206 for individuals and 2412 for married couples filing jointly up from 117 million and 234 million respectively for 2021. Estate Planning Strategies For Reducing Estate Taxes. Gift and Estate Tax Exemptions The Unified Credit.

If you made a 1 million gift to a child during your lifetime that would be subtracted from what you could transfer to anyone at death ie under current law that would leave you with 4340000 to transfer to anyone estate and gift tax free. Your gifts can total 32000 for the year if you want to give two people each the annual exclusion amount. Gift Tax Credit Equivalent 2141800 4417800 4505800 4577800.

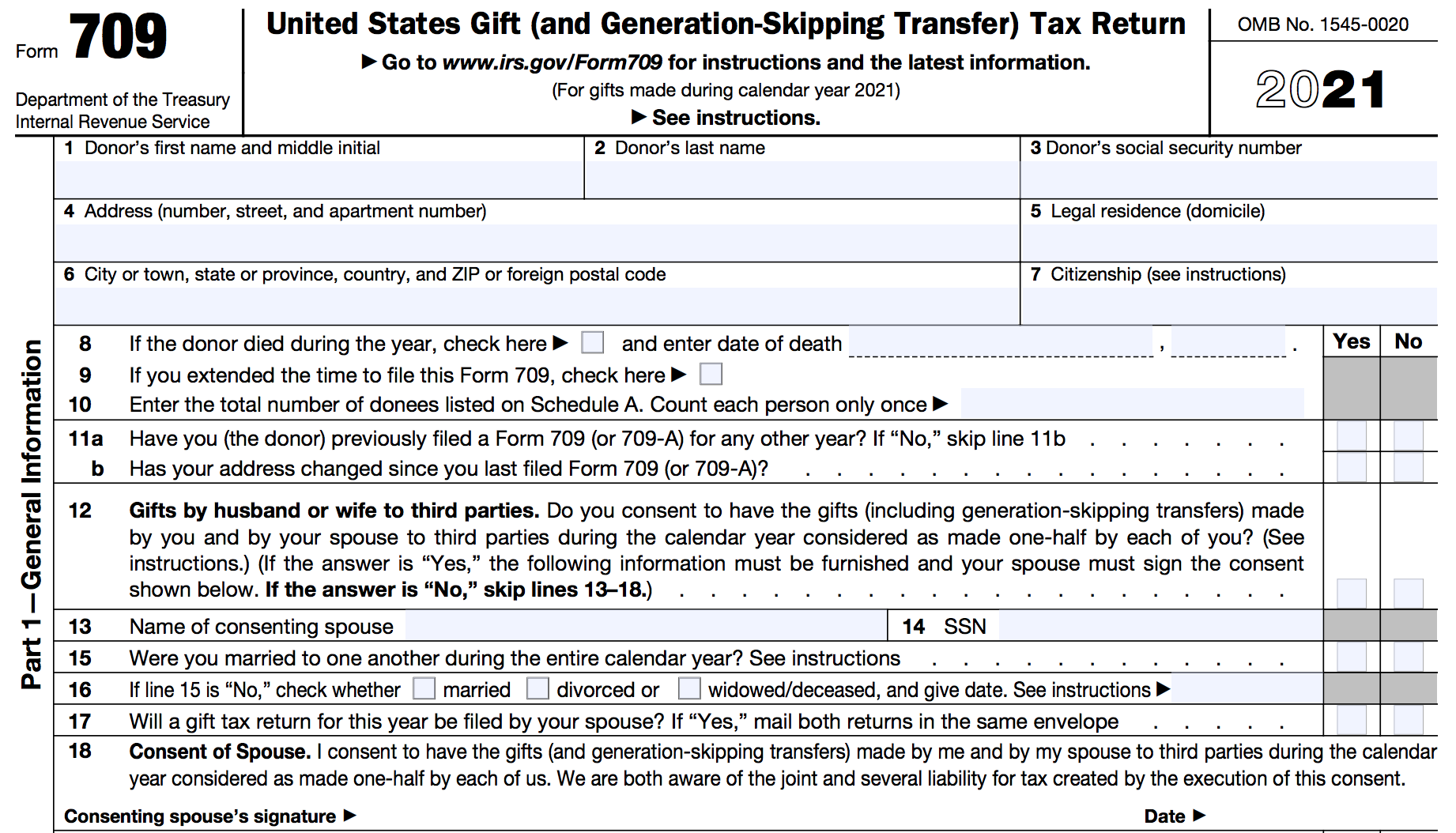

The IRS places restrictions on gifts given to people other than your spouse. The applicable credit amount is commonly referred to as the Unified Credit because it is both unified ie it is a single amount that is applied to transfers otherwise subject to either the gift tax or the estate tax and a tax credit ie it reduces the amount of tax owed. If a gift is given as a present interest gift meaning it is given outright to a person then the amount is not added into your total lifetime unified gift and estate tax credit.

Instead these gifts are limited to 15000 per person annually. Gifts have been taxed since 1924 and in 1976 Congress enacted the generation-skipping transfer GST tax and linked all three taxes into a unified estate and gift tax. The unified credit is per person but a married couple can combine their exemptions.

1997 hereinafter TRA 1997 the exemption equivalent amount of the unified estate and gift tax credit was 600000. When an estate is below the unified gift and estate tax credit limit there will be no estate tax due at the time of death. The gift and estate tax exemptions typically enable wealth to be passed on from one generation to the next tax-free.

For instance lets say you give your grandson a gift of 25000 in 2022. A person giving the gifts has a lifetime exemption from paying taxes on those gifts until they reach a certain figure. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Find some of the more common questions dealing with basic estate tax issues. Table 1 Summary of Estate and Gift Tax Rates and Exemptions 1977 to 2015 Current Law In 2017 the effective estate and gift tax rate is 40 and applied to an individuals cumulative taxable gifts and bequests. Beginning in 1998 the unified credit will be gradually increased to 1 million by.

Since 2000 the estate and gift tax collectively called the transfer tax has gone from an exemption of 675000 and a top marginal rate of. Learn about the COVID-19 relief provisions for Estate Gift. In 2022 couples can exempt 2412 million.

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

2021 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

Estate Planning Strategies For Gift Splitting Fidelity

Federal Marginal Tax Rates After Unified And State Death Tax Credits 1997 Download Table

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Here Are The 2020 Estate Tax Rates The Motley Fool

Gift Tax Unified Tax Credit Estate Tax Corporate Income Tax Course Cpa Exam Far Youtube

Estate Tax Primer For German Investors In U S Real Estate Partnerships Dallas Business Income Tax Services

Tax Related Estate Planning Lee Kiefer Park

Historical Estate Tax Exemption Amounts And Tax Rates 2022

History Of The Unified Tax Credit Apple Growth Partners

Historical Estate Tax Exemption Amounts And Tax Rates 2022

How To Fill Out Form 709 Step By Step Guide To Report Gift Tax Smartasset

What It Means To Make A Gift Under The Federal Gift Tax System Agency One

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

A Look At 2020 Cost Of Living Adjustments And Estate Gift Tax Limits Cpa Boston Woburn Dgc

What Is The Estate Tax And Will It Change Building Wealth Blog